how to claim california renter's credit

Check the box Qualified renter. In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a tax credit of 60 or 120 respectively.

Eviction Notice Printable Eviction Notice Eviction Notice Letter Templates Free Being A Landlord

Lacerte will determine the amount of credit based on the tax return information.

. Go to the Input Return tab. The california requirement for renters credit states the person must be living in their primary residence for more than half the year. Mark the checkbox labeled Qualified renter.

The renters credit was suspended for the 1993 through 1997 tax years but was reinstated effective January 1 1998 for the 1998 and all future tax years. California Resident Income Tax Return Form 540 2EZ line 19. The other eligibility requirements are as follows.

While the amount of the credit is modest at 60 for an individual or 120 for a taxpayer with the head of household status or a. The maximum credit is limited to 2500 per minor child. Complete the worksheet in the California instructions to figure the credit.

The credit is a flat amount and is not related to the amount of rent paid. File your income tax return. I lived and payed rent in an apartment for all of 2017 and part of 2018.

There is good news for renters living and paying taxes in California. To claim the CA renters credit. California allows a nonrefundable renters credit for certain individuals.

California Gives Renters a Tax Credit. Hawaii renters who make less than 30000 per year and pay at least 1000 in rent for their. Locate the Renters Credit section.

Under California law qualified renters are allowed a nonrefundable personal income tax credit. How you get it. Fill out Nonrefundable Renters Credit Qualification Record available in the California income tax return booklet for your own tax records dont send the form to the FTB with your tax return.

Updated - May 2022. Depending upon the CA main form used the output will appear on Line 46 of the Form 540 or Line 19 of Form 540 2EZ. In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively.

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. Renters Tax Credit Applications for 2022 will be available for Maryland tenants on Feb. You must have a California Adjusted Gross Income or AGI of less than a.

A person who rents or leases a homestead subject to a service charge instead of property taxes can claim a credit based on 10 percent of the gross rent paid. To claim the ca renters credit. To claim the renters credit for California all of the following criteria must be met.

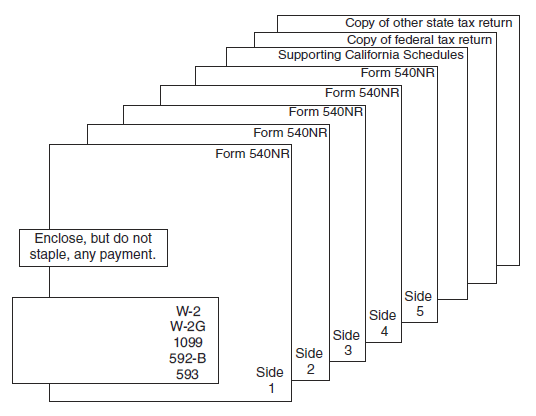

Go to Screen 53 Other Credits and select California Other Credits. The Nonrefundable Renters Credit is a personal income tax credit that is nonrefundable and can only be used to offset your tax liability meaning that if you dont owe any taxes this credit will NOT give you a refund. File either a California form 540 complete line 31 540A line 19 or 540 2EZ line 13 tax return.

Use one of the following forms when filing. What is California Renters Credit. Select CA Other Credits.

A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4. California Nonresident or Part-Year Resident Income Tax Return line 61. You must be a California resident for the tax year youre claiming the renters credit.

California tenants could get an expanded renters tax credit if Legislature passes bill backed by Democrats and Republicans. To claim the CA renters credit. It can only lower the amount you owe to 0.

California Resident Income Tax Return Form 540 line 46. You must have been a resident of California in the previous tax year. Your California adjusted gross income AGI is 45448 or less if your filing status is Single or Married Filing Separately or 90896 or less if you are Married Filing Jointly.

To see if youre eligible first find your gross household income on the chart in Column A. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident. California allows a nonrefundable renters credit for certain individuals.

You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria. For the requirements you need to meet please see Nonrefundable Renters Credit. The qualifications for claiming the nonrefundable California Renters Credit include the following.

Can I claim the renters credit on a mobile home lot rent I pay in California. I was able to claim the Renters Credit on my 2017 return. Part way through 2018 I moved into a room in a house that I am now paying rent to the homeowners and I am not a member of their family so I am unsure if i can still use the Renters Credit.

The Criteria to claim CA Renters Credit. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident. Kristina Brewer Dec 24 2019.

From the left of the screen select State Local and choose Other Credits. You were a resident of California for at least 6 full months during 2021. If you qualify for the credit well calculate the amount of credit youre allowed.

Who can claim the renters tax credit. If it exceeds the number in Column B you qualify for a tax credit of as much as 1000. The program will determine the amount of credit based on the tax return information.

You paid rent for a minimum of six months for your principal. Renters Credit Nonrefundable. That is California is one of a handful of states that does permit renters to make a claim to reduce taxable income through a renters tax credit.

15 2022 and you can file online. Only the renter or lessee can claim a credit on property that is rented or leased as a homestead. To claim the renters credit for California all of the following criteria must be met.

June 1 2019 246 PM. Assuming that you meet all of the requirements space rental for a mobile home would qualify you for the credit. Nonresidents cannot claim.

Michigan allows renters or lessees of homesteads to claim a credit based on 20 percent of the gross rent paid. In 2008 a 120 credit is. Only the renter or lessee can claim a credit on property that is rented or.

If you paid rent for six months or more on your main home located in California you. Visit Nonrefundable Renters Credit Qualification Record for more. The maximum credit is limited to 2500 per minor child.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Arizona Rental Application Form Download Free Printable Rental Legal Form Template Or Waiver In Different Editab Rental Application Arizona Rental Space Names

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Settlement Agreement Sample Check More At Https Nationalgriefawarenessday Com 39514 Settlemen Divorce Settlement Agreement Debt Settlement Divorce Settlement

Renters Insurance Guide Insurance Com Best Renters Insurance Renters Insurance Renter

How California Renters Are Bracing For An Eviction Tsunami California Borrow Money Tsunami

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Tax Return Irs Forms

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Form 540 California Resident Income Tax Return

Free 9 Sample Rental Application Forms In Pdf Ms Word Excel